Employment in the printing industry in North America is expected to decline, but the need to replace workers who retire or leave the occupation will create job opportunities, especially for persons with contemporary up-to-date printing skills. Changing technology and new business models that make greater use of digital equipment and shorter-run print jobs is expected to slow the rate of decline and provide job opportunities in an evolving printing industry.

Wage and salary employment in the printing and related support activities industry is projected to decline 16 percent over the 2008–18 period, compared with 11 percent growth projected for the economy as a whole. This decrease reflects the increasing automation of the printing process and the expanding use of the Internet that reduces the need for printed materials. Some small and medium sized firms are also consolidating in order to afford the investment in new technology and equipment leading to an expected drop in employment. However, digital printing and shorter run print capabilities allow many printers to accept smaller job orders and remain profitable, thus stemming the level of employment decline somewhat.

Processes that had been performed manually are now largely automated. As a result, job skills have changed and nearly all workers need to be computer literate and comfortable working with increasingly sophisticated equipment. Some jobs have shifted from production occupations to computer-related occupations that perform the same functions while others have vanished. Case in point, demand for workers who perform prepress tasks manually such as paste-up workers, photoengravers, camera operators, film strippers, and platemakers can be expected to disappear. In some cases, technological advances have shifted job duties from printers to printers’ clients. For example, as layout and design are performed and transmitted electronically to printing companies, employment of desktop publishers and graphic designers in client industries should grow.

Growth in mechanization in bindery operations should result in declines in the employment of bindery workers. While the need for manual binding has declined, the demand for hand finishing operations, such as individualized enhancement services generally provided for high end or one-of-a-kind publications, has grown offsetting some of the employment decline in bindery and finishing departments. Employment of bookbinders, who do very skilled craft work by hand, also will decline mostly due to falling demand for their services. Increasing sophistication of printing presses will lead to a net decline in the employment of printing machine operators; however, increased capabilities for producing smaller quantities of job output will lead to increases in job orders thus offsetting employment declines.

Many printers are expanding the number of secondary services they offer in response to an increasing number of alternatives to traditional printing services. These services include mailing, shipping, and performing inventory and database management for customers. Growth in these services, coupled with increases in digital printing capabilities, will moderate the decline in employment of printing’s production occupations and create new opportunities for workers with customer service, graphic design, or information technology abilities.

Despite the projected downturn in employment in printing, retirements and turnover will continue to generate job openings, especially in firms that feature large-press printing or small-run, customizable print products. Opportunities should be best for those with computer, graphic design, communications, media and marketing skills.

Even with the recent uncertainty of trade relations with the U.S., it has not impacted the Canadian economy as one may have expected. In fact, according to a RBC Economic Outlook Report released in September 2018, consumer spending and business investment remains optimistic into 2020.

According to economist and author Andrew D. Paparozzi, in terms of overall business conditions, 2019 will look a lot like 2018 for the commercial printing industry. Sales (all sources) will grow 1.5%-2.5%, to $87 billion, after growing roughly 1.7% this year, according to SGIA. And the intense pressure on margins will continue — created again by tight paper markets, tight labor markets, excess capacity and rising tariffs.

But there’s a lot more to commercial printing’s story than overall business conditions. There’s also ongoing change in what a commercial printer is and does — structural labor shortages; print’s changing role in communication; personalization, integration and interactive/mobile; and the realities of diversification.

Industry Convergence Trend Confirmed

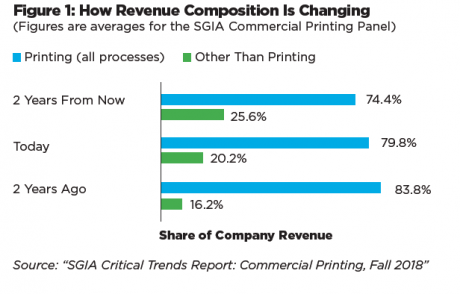

A recent survey of the SGIA Commercial Printing Panel fills in the details. We first asked the panel to describe their companies. Responses show how extensively roles are changing. For example, more than 47% now describe themselves as a combination of company types rather than a single company type. Descriptions include provider of mailing services (42.6%), provider of fulfillment services (28.2%) and provider of marketing services (20.1%). And while 72.7% include “general commercial printer” in their description, just 34% define themselves exclusively as a general commercial printer. A discussion of revenue composition reinforces three critical points. First, the trend is clearly toward print, with our research group expecting something other than printing to provide, on average, 25.6% of their revenue by 2020, up from 20.2% today and 16.2% two years ago. (See Figure 1) Second, not everyone is diversifying. Slightly more than one-fifth still get at least 90% of revenue from print and don’t expect that to change. More than a few are making it work.

And, third, there’s big change within print. The panel projects revenue increases over the next two years, averaging 9.4% for wide-format, 5.6% for variable-content toner digital, 4.1% for inkjet and decreases averaging 1.1% for lithography.

We asked how client needs are changing. We learned that there is growing demand for faster turn times and shorter, more targeted runs; a broader range of services; advanced designs and special finishing to create distinctive print — the “wow factor” as one member of our panel puts it; and help maximizing the return on their communications dollar. That means:

- More moving parts. It isn’t just getting faster on a vanilla job. It’s quickly pulling together services, from database management to the design of standout direct mail, to the creation of multi-media communications programs.

- Minimizing the friction all those moving parts created by automating and smoothing workflows. “The more integration front to back, the more efficient we become” — minimizing steps and touches, eliminating processes that no longer add value, and the more efficient purchase and inventory of essential materials and supplies.

- Showing clients exactly how much value we create for them because they want more and faster, but aren’t always willing to pay for it.

- Pricing services added, whether individually or as part of a marketing/communications package, for competitiveness and profitability.

- Deciding how much to do inside and how much outside. Inside means more control and “one-stop shopping that simplifies the buying experience for clients.” Outside (with the right partner) means access to experience and expertise we don’t have and may not easily develop.

Concerning labor shortages, the challenge for commercial printing goes beyond the cyclical — a 49-year low unemployment rate — to the structural — an old-economy image that makes it difficult to attract young personnel. The Print and Graphics Scholarship Foundation (PGSF) is one of the organizations working to correct that image. Every company that prints should be familiar with its “Graphic Communications as a Career,” “Adventures in Print: Choose Your Career in Graphic Communications,” and other resources.

And then there’s what the “SGIA Critical Trends Report: Commercial Printing” describes as “thinking big and thinking carefully.” The big part is thinking beyond how print is manufactured to how print powers communication — particularly personalized, integrated, interactive/mobile communication. We asked our research panel where, if at all, the three fit in their plans. Among the responses, summarized in Figure 2:

- Personalization. Nearly half (49.5%) are all in and nearly one-quarter (24.3%) have gotten started, but aren’t sure how far they will take it. The difficulty of managing and securing complex databases and ensuring accurate personalization are obstacles for many.

- Integration. More than 50% are either all in (25.2%) or have gotten started (26.2%). But integration hasn’t won everyone over: 24.3% are thinking about it and 17.8% plan to stay focused on printing.

- Interactive/mobile. Only 17.1% have gotten started, while 32.4% do not include interactive/mobile in their plans.

Thinking carefully pertains to all diversification. It means we don’t rush in — no matter how much buzz that hot, new service is creating — but instead ask and honestly answer the following questions:

- How important is the service to our clients and prospects? Is it a must-have or nice but not essential? Can we prove it is a must-have?

- What’s really necessary to offer the service profitably?

- How will we market, sell and price the service?

- Do we have the personnel to offer it profitably? If not, where do we get them?

- Do we try it on our own? Or do we partner with an expert until we get to critical mass and high enough on the learning curve?

By taking those questions on, we greatly reduce the likelihood of missing an opportunity or of chasing something that, given our resources, capabilities and goals, will never be an opportunity.

We closed our survey by asking about the future. One Commercial Printing Panel member captured the thoughts of many when he described the future this way: “Our industry continues to evolve and it is not just a print business anymore. It is about communications and how we can best help clients communicate their message. If we help them get noticed we help them get business — that is what they are really paying us for!”

Productivity-enhancing, market-expanding technology will be necessary to achieve that future but not sufficient. We’ll also need advanced leadership and management skills. Companies that cultivate those skills will be the big winners. The more that do that, the more promising the commercial printing industry’s prospects in 2019 and beyond.

A couple of areas of interest are Wide-format Printing and Out-of-Home Advertising:

The global value of the large-format printer market is forecast to experience a compound annual growth rate (CAGR) of four per cent, according to research firm Markets and Markets, rising from nearly US$8.4 billion in 2017 to nearly US$10.6 billion in 2023.

The company attributes this growth to increasing demand for large-format printing in the textile, advertising, and packaging industries. The outdoor advertising sector, for example, has seen growth in the adoption of printers with ultraviolet-curable (UV-curable) inks, as they dry quickly and are compatible with a wide range of substrates.

Markets and Markets’ global forecast for this sector takes into account all large-format printers, raster image processor (RIP) software, inks—including solvent-based, aqueous, UV-curable, durable aqueous ‘latex,’ and dye sublimation formulations—and related services.

Printers between 1.1 and 1.5 m (44 and 60 in.) wide are expected to represent the largest share of the market between 2017 and 2023. They are well-suited for producing point-of-purchase (POP), event, and floor graphics, among other indoor and outdoor signage. Secondary applications include fine art and photo printing.

On a global scale, the Americas hold the largest share of the market. This region’s signage industries continue to grow as more companies invest in both outdoor and indoor advertising.

As for Digital out-of-home advertising can comprise a variety of screen shapes, sizes, and levels of interactivity, making it one of the fastest growing and interactive forms of advertising.

In fact, McRae says marketers and advertising are increasingly turning to out-of-home (OOH) media and to better handle this demand by offering better campaigns, the OOH industry is in the midst of a dramatic shift to digital technology. It enables advertisers to create campaigns that are highly targeted, interactive, and offer intelligent content based on an ever-growing mountain of actionable data.

The global DOOH market is expected to get bigger at a compound annual growth rate of 12.6 per cent from 2017 to 2023, according to a report by Allied Market Research. It also predicts the market will reach more than $8 billion within the next five years. The billboard segment held the highest market share in 2016 will continue to grow by 12.8 per cent from 2017 to 2023.

*Andrew D. Paparozzi (Author’s Page)

Andrew D. Paparozzi joined SGIA as Chief Economist in 2018. He analyzes and reports on economic, technological, social and demographic trends that will define the printing industry’s future. His most important responsibility, however, is being an observer of the industry by listening to the issues and concerns of company owners, executives and managers. Previously, he worked 31 years at the National Association for Printing Leadership. He has also taught mathematics, statistics and economics at various colleges. Andrew holds a Bachelor’s degree in economics from Boston College and a Master’s degree in economics — with concentrations in econometrics and public finance from Columbia University.